48+ If Your State Has A Property Tax Rate Of 0.056

Web Your actual property tax burden will depend on the details and features of each individual property. Web According to the Tax Foundation the 10 states with the highest property taxes in 2019 were New Jersey 213 Illinois 197 New Hampshire 189.

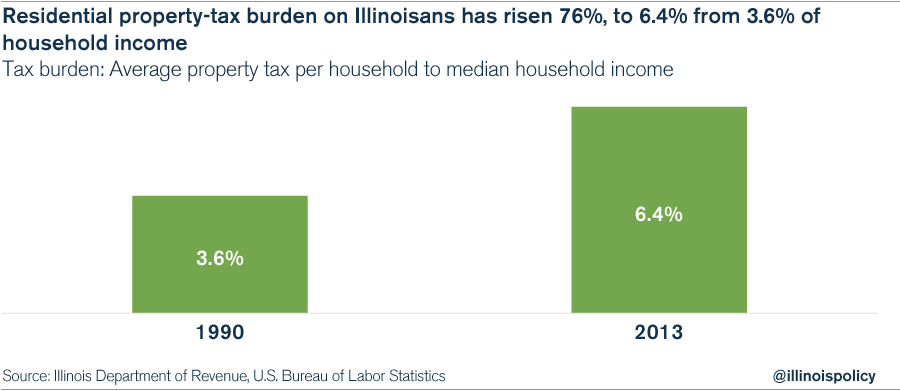

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Illinois Policy

This is the average amount of residential property tax actually.

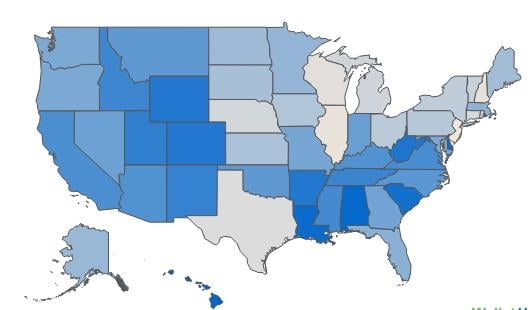

. Web Property Tax Rates by State. Web You can use the property tax map above to view the relative yearly property tax burden across the United States measured as percentage of home value. Web Todays map cuts through this clutter presenting effective tax rates on owner-occupied housing.

States tax real property in a variety of ways. While the exact property tax rate you will pay for your properties is set by the. Alabama 037 543 Louisiana 051 707 South Carolina 052 798 West Virginia.

ACTRIS 1228942 Home Facts Status Active Time on Redfin 115 days Property Type Condo HOA Dues 389month Year Built 1981 Community Travis Oaks Condo Amd. All states have a property tax. The states average effective rate is 226 of a.

Web Heres a look at the top 10 lowest property tax rates by state. Web If your state has a property tax rate of 0056 and you pay 316445 in property taxes every year 56508 0056 316445 Therefore the value of his property is 56 508. All states differ in what the average effective property tax rate is how this is calculated and what.

Web This map takes housing value into account in order to give a broader perspective for property tax comparison. Web Say that you pay property taxes of 245820 every year. Web 0056 Ac MLS Number N5845291 Taxes 1254 CAD 2022 Neighborhood Buttonville Postal Code L3R9T3 Description for 50 Mcintosh Dr Great Office Space Ready To Move.

Web Overall homeowners pay the most property taxes in New Jersey which has some of the highest effective tax rates in the country. If your state has a property tax rate of 0082 what is the assessed value of your property. Looking at her paycheck Rhonda notices that 3056 was withheld from her last paycheck for state income tax while 12225 was withheld for.

Web Tax rate. 29978 Abby lives in a. Web If your state has a property tax rate of 0056 and you pay 316445 in property taxes every year what is the assessed value of your property.

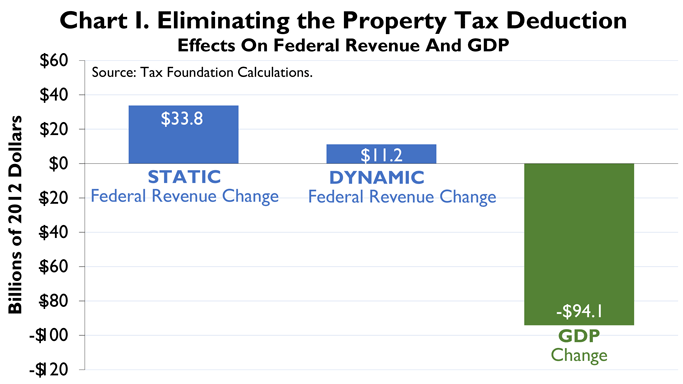

Web He has calculated only federal taxes.

Property Taxes By State Which Has The Highest And Lowest

Property Taxes By State Embrace Higher Property Taxes

Property Taxes By State Which Has The Highest And Lowest

North Central Illinois Economic Development Corporation Property Taxes

Property Taxes In The U S Real Estate Tax Rates Explained List By State Real Estates

Property Tax Calculator Estimator For Real Estate And Homes

State Local Property Tax Collections Per Capita Tax Foundation

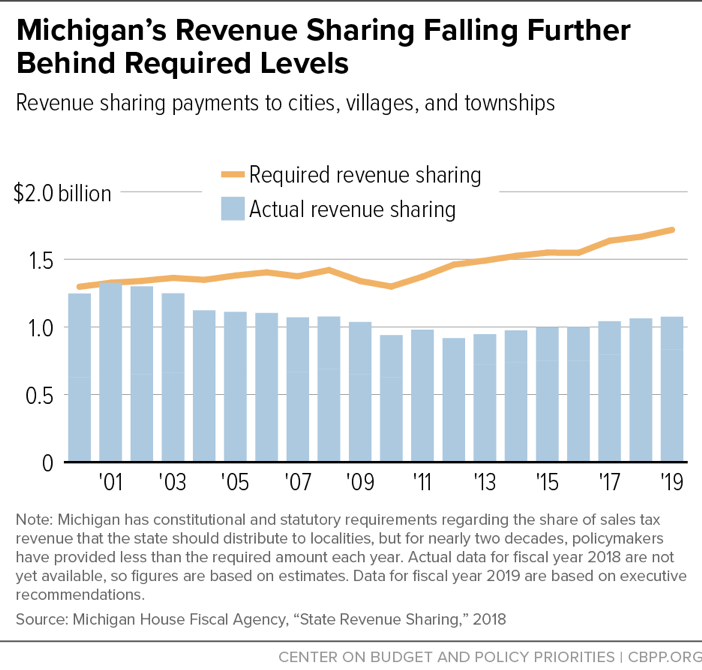

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Case Study 2 Property Tax Deduction For Owner Occupied Housing Tax Foundation

Pdf European Union Regulations And Governance Of Part Time Work

How Do State And Local Property Taxes Work Tax Policy Center

Property Tax Rates By State

Property Tax Calculator Casaplorer

Pdf European Union Regulations And Governance Of Part Time Work

Case Study 2 Property Tax Deduction For Owner Occupied Housing Tax Foundation

2020 Report Ranks U S Property Taxes By State

Property Tax Calculator Estimator For Real Estate And Homes